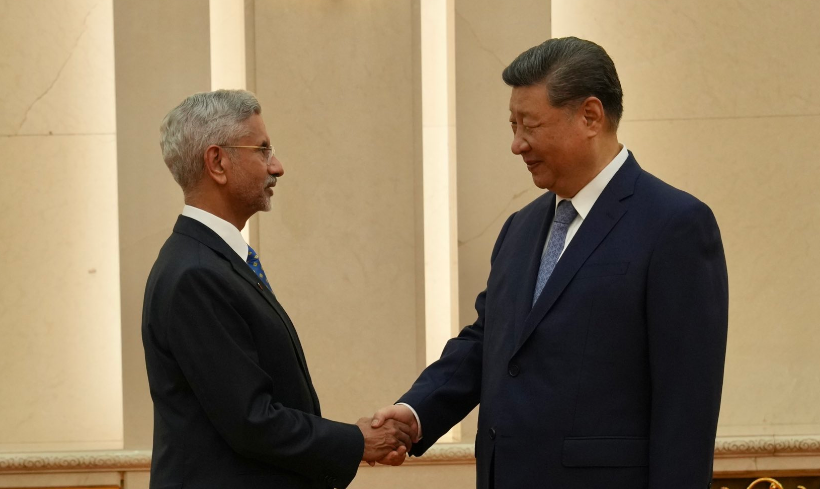

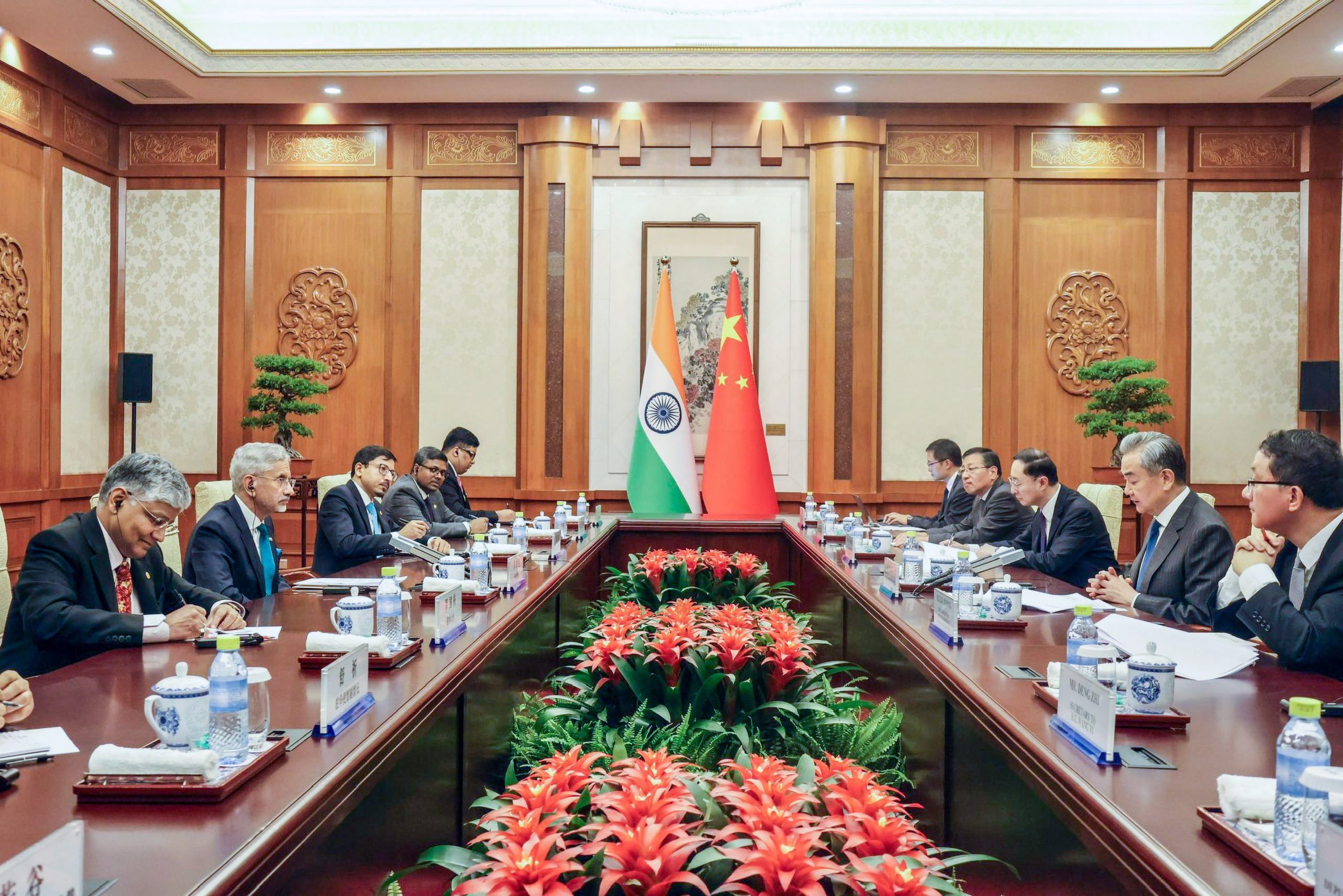

India, Mauritius Sign Protocol To Amend Tax Treaty

Tue 16 Apr 2024, 11:03:25

India and Mauritius closed another lacuna in their Double Taxation Avoidance Agreement (DTAA), tightening the scrutiny on tax avoidance on investments coming into India. The new protocol on DTAA was signed on the 7th of March this year. The latest amendment includes a Principal Purpose Test (PPT) to decide whether a foreign investor is actually eligible

for treaty benefits, or was the tax benefit the primary reason to route investments via Mauritius.

for treaty benefits, or was the tax benefit the primary reason to route investments via Mauritius.

DTAA is a bilateral agreement aimed at preventing double taxation of income earned in one country by residents of the other country (India & Mauritius in this case).

No Comments For This Post, Be first to write a Comment.

Most viewed from Specials

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)