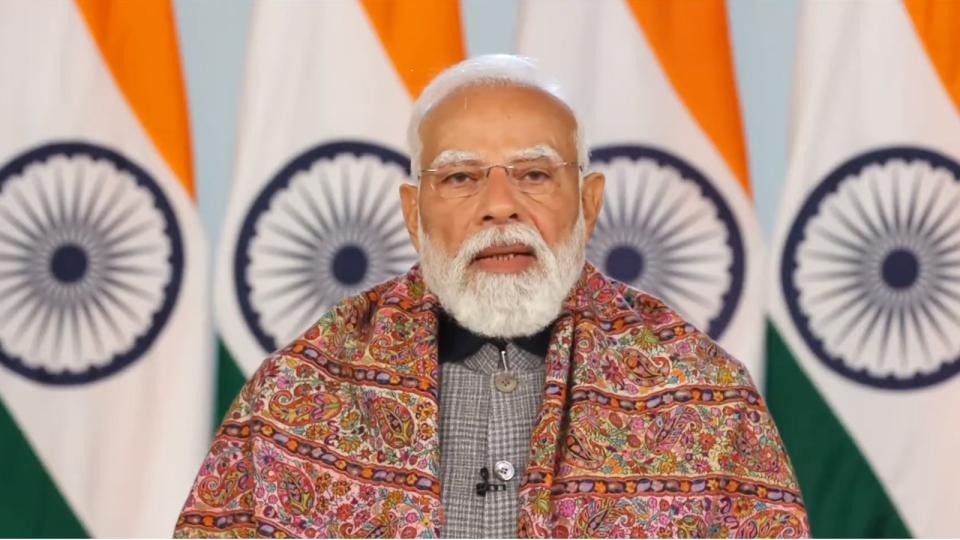

Pradhan Mantri Jan Dhan Yojana completes seven years today

Sat 28 Aug 2021, 10:27:47

New Delhi: Central government’s flagship financial inclusion programme, Pradhan Mantri Jan Dhan Yojana completes seven years today. The scheme was launched on this day in 2014 with an aim to provide universal access to banking facilities to the people across the country. Under this scheme, bank accounts are being opened with minimal paperwork and zero balance.

Indigenous Debit cards are being issued for cash withdrawal and payment at merchant locations with free accident insurance coverage of two lakh rupees. Besides, other financial facilities including micro-insurance, overdraft for consumption and micro-pension are also being offered.

One of the biggest financial inclusion schemes in the world, the Pradhan Mantri Jan Dhan Yojna has made remarkable progress in providing banking and other financial services to the marginalized and

poor sections of the society. In the last seven years, it has not only helped the poor in bringing their savings into the formal financial system but also provided an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

poor sections of the society. In the last seven years, it has not only helped the poor in bringing their savings into the formal financial system but also provided an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

So far, over 43 crore four lakh bank accounts have been opened under the scheme and more than one lakh 46 thousand crore rupees balance are in the beneficiary accounts. Over 31 crore Rupay Debit Cards have been issued to beneficiaries. A large number of Pradhan Mantri Jan Dhan Yojana account holders are also receiving direct benefit transfer from the government under various welfare schemes. As financial inclusion is a national priority for the government, this scheme has proved to be one of the key enablers for inclusive growth.

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)