No GST on free food served at religious institutions

Tue 11 Jul 2017, 19:48:47

The government on Tuesday clarified that all free food supplied at religious institutions is exempt from the Goods and Services Tax (GST).

“There are media reports suggesting that GST applies on free food supplied in anna kshetras run by religious institutions,” the Ministry of Finance said in a statement. “This is completely untrue. No GST is applicable on such food supplied free.

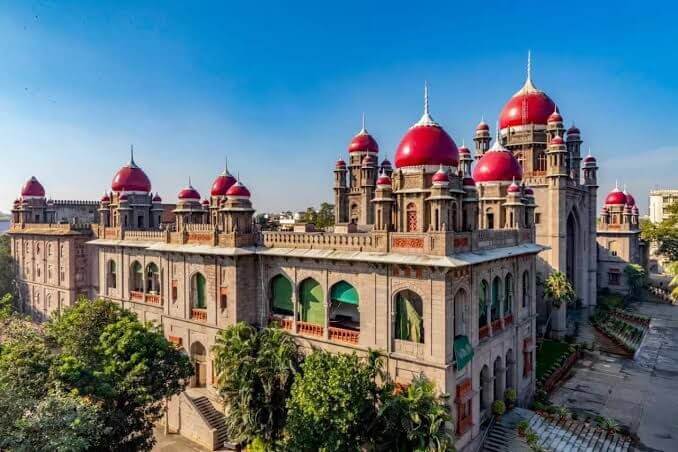

“Further, prasadam supplied by religious places like temples, mosques, churches, gurudwaras, dargahs, etc attracts nil CGST and SGST or IGST, as the case may be.”

However, the government added that some of the inputs and input services-such as sugar, vegetable edible

oils, ghee, butter, and the service for transportation of these goods-required for making prasadam are subject to GST.

oils, ghee, butter, and the service for transportation of these goods-required for making prasadam are subject to GST.

“Most of these inputs or input services have multiple uses. Under GST regime, it is difficult to prescribe a separate rate of tax for sugar, etc when supplied for a particular purpose.

“Further, GST being a multi-stage tax, end-use based exemptions or concessions are difficult to administer,” it added. “Therefore, GST does not envisage end-use based exemptions. It would, therefore, not be desirable to provide end-use based exemption for inputs or input services for making prasadam or food for free distribution by religious institutions.”

No Comments For This Post, Be first to write a Comment.

Most viewed from National

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)