Telangana Assembly ratifies GST; adjourns sine die

Mon 17 Apr 2017, 12:33:17

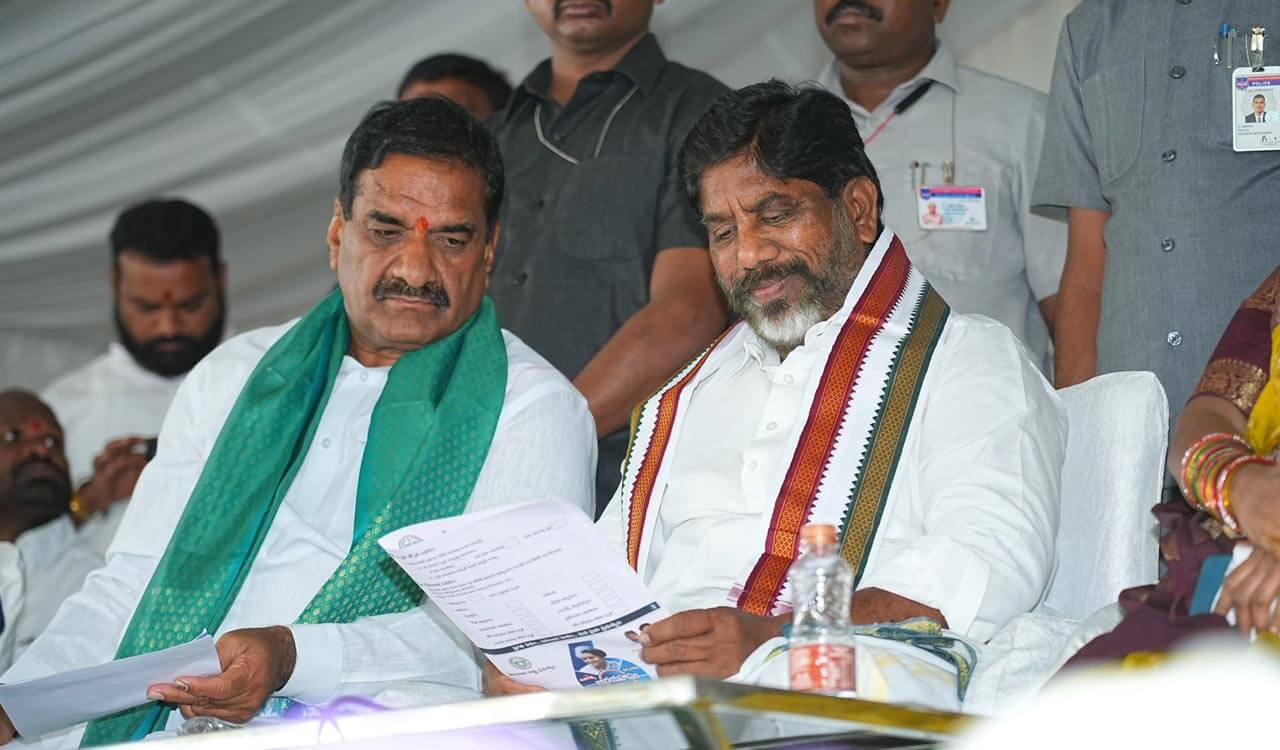

The Legislative Assembly special session on Sunday ratified the Goods and Services Tax (GST) Act passed by the Centre. Finance Minister Eatala Rajender introduced the State GST Bill in the Assembly after it passed the Reservations Bill for Scheduled Tribes and Muslim Minorities.

Rajender gave clarifications to the queries posed by the members on the GST Bill after a brief discussion, and explained as to why the Telangana government is extending support to it. Stating that the aim of the GST is ‘one nation - one tax regime’, he said direct taxes were not coming into the ambit of GST. The Finance Minister, extending support to the GST Bill passed by the Centre, said indirect tax of Customs Department would come under the Central government purview rather than the GST tax regime. Rajender maintained that as many

as 160 nations out of 196 nations were implementing the GST system.

as 160 nations out of 196 nations were implementing the GST system.

The Centre, he said, had exempted alcohol and petroleum products from the GST ambit. The Telangana government had urged the Centre to give tax exemptions to agriculture produces, he informed the House. Union Finance Minister Arun Jaitley had constituted a GST Council and the uniform tax regime of GST would come into force across the nation from July 1, Rajender said. The Centre, through the GST Council, would compensate the States for five years to meet the losses to be incurred by the implementation of uniform regime of GST, he stated.

After the members responding on the Bill with some suggestions, the House ratified the GST Bill. The Assembly was later adjourned sine die by Deputy Speaker Padma Devender Reddy.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)