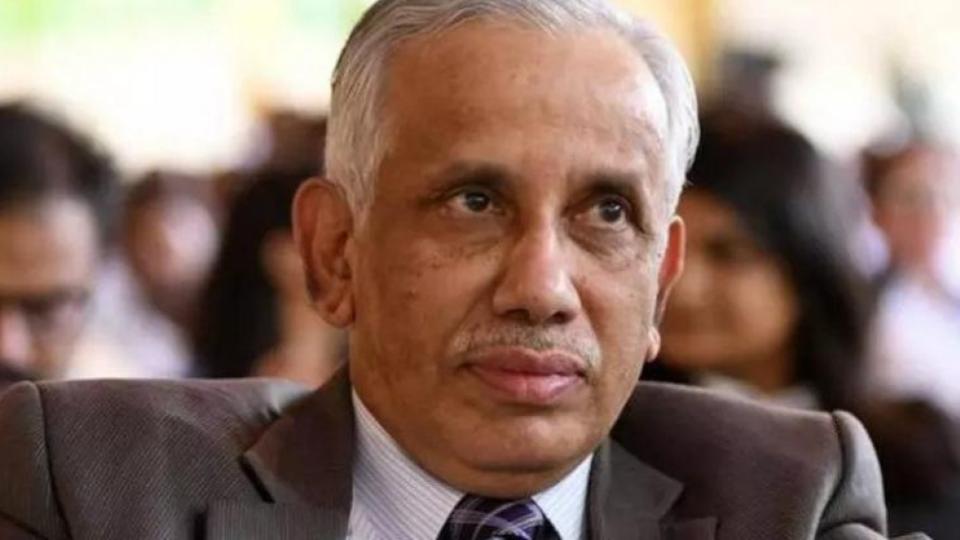

GST ensures transparency: Finance Minister Etela Rajender

Mon 20 Feb 2017, 12:16:30

Finance Minister Etela Rajender on Sunday expressed confidence that implementation of GST would avoid confusion and ensure transparency across the nation.He exhorted gems and diamonds businessmen to earn money legally and pay taxes to the government. Payment of taxes would increase the coffers of the State and the Central government, he said.

When a delegation of All India Gems and Diamonds Federation called on him and wanted inclusion of 1.25 per cent tax in the forthcoming GST regime across the nation, the Minister said the Centre held discussions and was planning to levy 4 per cent tax. The current business of Gems and Diamonds industry is put at Rs 3 lakh crore in the country, contributing 6 per cent share in the GDP. The jewellers sought to increase their share in the GDP if

the Centre encouraged their business with low tax of 1.25 per cent.

the Centre encouraged their business with low tax of 1.25 per cent.

The Finance Minister stated that Telangana was the only State fighting with the Centre for practical taxation. The State government argued with the Centre in this regard to avoid unscientific method of taxation, he said. Rajender asked them to earn money and pay taxes to the government as evading the same would hamper the development process.

“Our aim is to see that more business transactions are done and zero business in the State comes to an end,” he said. The Minister expressed concern that unscientific method of taxation was forcing businessmen to avoid payment of taxes by resorting to wrong methods. “To put an end to this, we prefer to have practical taxation across the nation,” he said.

No Comments For This Post, Be first to write a Comment.

Most viewed from Hyderabad

Most viewed from World

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)