Traders below Rs.20 lakh turnover not to pay GST

The Centre and states

on Friday resolved a tricky issue of exemption limit, below which, traders will

not have to pay GST.But, the most contentious one of tax rates under the new

indirect tax regime, was left to be decided in next month’s meeting of the newly-created

GST Council.

The revenue exemption limit will be Rs 20 lakh for all states, with the exception of the North East, and the hill states, where the limit will be Rs 10 lakh. The exemption list has also been pruned to 90 goods and services, from the current 300.

On the issue of dual control affecting small businesses, the GST Council decided that states will get control over traders up to turnover of Rs 1.5 crore. A mechanism will subsequently be worked out so that even those above Rs 1.5 crore turn over do not face dual control.

The Centre will have

a control over tax-related issues of all services, given the lack of expertise

among states in the area. And, all prevailing cesses will be subsumed in the

GST.Emerging out of the first meeting of the newly-constituted GST Council,

Finance

Minister Arun Jaitley said, “All decisions have been arrived at by

consensus and there was no voting.”

2015-16 will be the base year for computation of revenues and compensations. The next crucial meeting of the council will be held during October 17-19, in which the GST rates are likely to be finalised. Before that a meeting will be held on September 30 to decide the draft rules of the GST Council, and nitty-gritties of exemption and administrative control.

“We will try to finalise the rates and the slabs during our meeting on October 17, 18 and 19,” Jaitley said.

Rate setting has emerged as the knottiest issue on way to GST since some states have demanded rates as high as 26-27%. Chief Economic Adviser Arvind Subramanian, however, has recommended a standard rate of 17-19% .

Experts welcomed the decision to merge all cesses in GST. The government aims at rolling out GST from April 1, 2017.

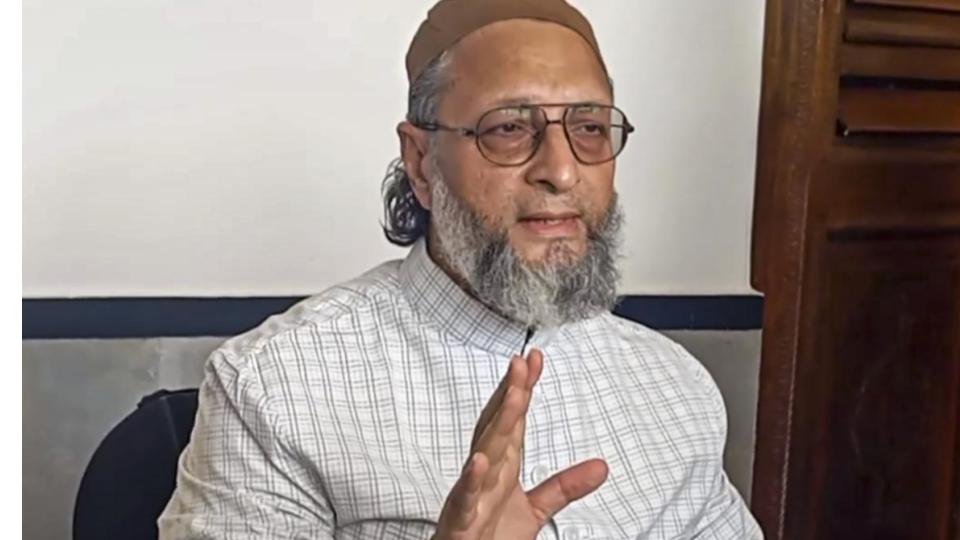

AIMIM News

Latest Urdu News

Most Viewed

Which cricket team is your favourite to win the T20 World Cup 2026?

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)