RBI hikes benchmark lending rate by 50 basis points to rein in inflation

Fri 30 Sep 2022, 10:58:01

Mumbai: The Reserve Bank of India (RBI) on Friday raised the benchmark lending rate by 50 basis points to 5.90 per cent in a bid to check inflation, which has remained above its tolerance level for the past 8 months

With the latest hike, the repo rate or the short term lending rate at which banks borrow from the central bank is now close to 6 per cent

This is the fourth consecutive rate hike after a 40 basis points increase in May and 50 basis points hike each in June and August. In all, RBI has raised benchmark rate by 1.90 per cent since May this year

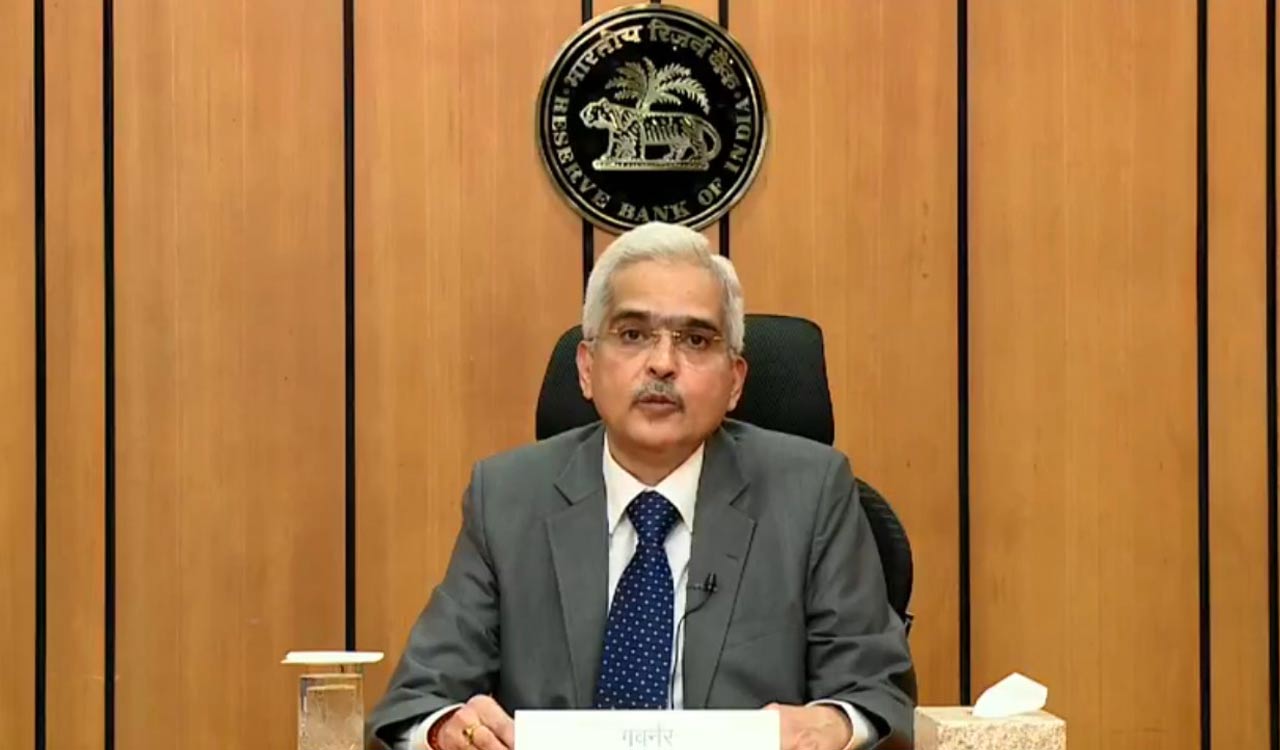

The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das decided in favour of the rate

hike

hike

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 7 per cent in August. Retail inflation has been ruling above the RBI's comfort level of 6 per cent since January this year

Das retained the inflation projection at 6.7 per cent for the current fiscal while slashing real GDP growth estimate to 7 per cent from earlier forecast of 7.2 per cent for FY'23

The latest RBI action follows the US Federal Reserve effecting the third consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 3-3.25 per cent earlier this month.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Should there be an India-Pakistan cricket match or not?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)