Foreign investors pump in Rs.10,312 crore in June so far

Mon 24 Jun 2019, 11:39:19

Overseas investors have infused more than 10,000 crore rupees in the domestic capital markets this month so far, with debt segment accounting for the lion's share.

Experts said that equity investments have slowed down on account of rising geopolitical tensions in West Asia as well as US-India trade conflict.

As per the latest depositories data, foreign portfolio investors, FPIs, pumped in around 552 crore rupees into

equities and around 9,761 crore into the debt market during Jun 3 to 21, taking the cumulative net investment to 10,313 crore rupees.

equities and around 9,761 crore into the debt market during Jun 3 to 21, taking the cumulative net investment to 10,313 crore rupees.

FPIs have been net buyers for the previous four consecutive months. They invested around 9,031 crore rupees in May, 16,093 crore rupees in April, 45,981 crore rupees in March and 11,182 crore rupees in February into the Indian capital markets-both equity and debt.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

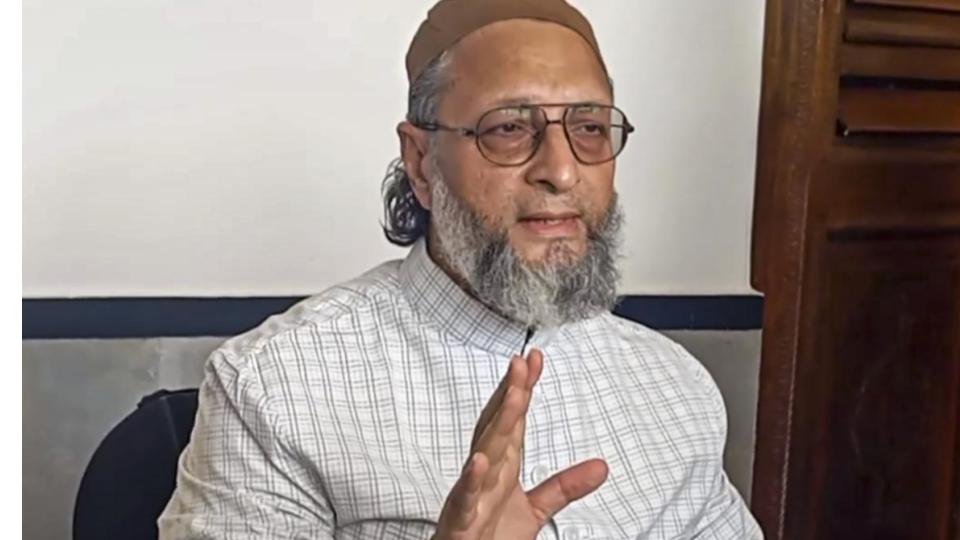

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which cricket team is your favourite to win the T20 World Cup 2026?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)