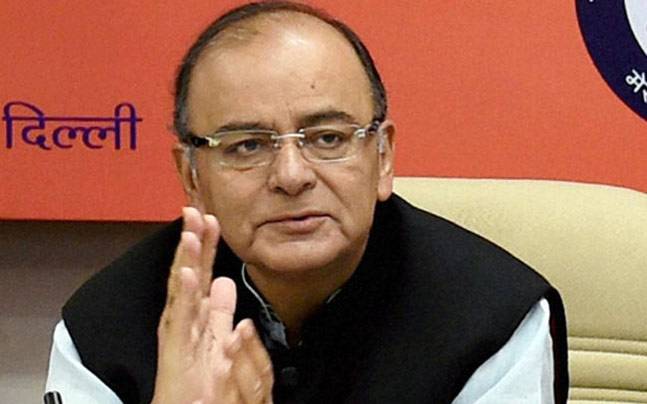

Banking is backbone of India's economy: Arun Jaitley

Mon 12 Nov 2018, 11:37:56

Stating that banking is the backbone of India’s economy, Union Finance Minister Arun Jaitley Sunday said, the country will soon have banking point within the reach of 5 kilometers for every citizen.

He said private banks rely on retail banking to grow, but nationalised banks have to focus on industry and infrastructure.

Keeping in mind the goal of financial inclusion, the Department of Financial Services will have a banking point within 5 km of every citizen, Finance Minister said while addressing through video conferencing during the centenary celebration of Union Bank of India in Mumbai.

He added that no citizen will have to travel beyond five kilometers for banking related work.

Jaitley said, in 2014 when the present government came to power, 58 per cent of the country’s population was connected to banking out of which, 42 per cent lived entirely outside the system.

He said it goes to the credit of the banking institutions that in a matter of few weeks the banking institutions reached out to every household in the country, barring few extremist areas.

Jaitley further said that despite higher oil prices and periodic slowdowns, the Indian Economy has clocked good growth rate. NPAs of banks needs to be curbed as healthy banks are necessary for growth of economy.

He pointed out that the problem of NPAs which arose due to indiscriminate lending was concealed for a long time, but government adopted a multi-pronged approach and government will ensure that dishonest decisions and not erroneous ones are to be

prosecuted.

prosecuted.

Highlighting India’s jump in the ease of doing business from 142 to 77th rank according to the World Bank report, the FM said, it has radically improved, and attributed the fact that Centre and the states are cooperating in making India a much easier place to do business.

Jaitley also appealed the banks to minimise the non-profiting assets or the NPAs, saying that multiple options were exercised in the past but it did not yield much result. However, he said, what is being experimented now is bringing results, surely but shortly.

The finance minister batted for providing credits to MSME sector and also to other players in the market. He said even the NBFCs need the credit.

Talking about the steps taken by the government to boost the banking sector, Jaitley said, in last four years, in two installments the government has brought in Rs. 70,000 crore and Rs. 2,12,000 crores in order to add to the banking capitalisation to enable public sector banks to get out of the challenges that they face and to improve upon their lending capacity.

He said it was the formalisation of the economy that enabled the government to make sure that within weeks of the seventh pay commission it was implemented without reducing any recommendation.

He said, the strength of the banking needs to be improved so that they should be in a position to give credit and to maintain liquidity in the market.

The future of the economy growth depends on the lending capacity, he added.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Is it right to exclude Bangladesh from the T20 World Cup?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2026 Etemaad Daily News, All Rights Reserved.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)