SBI steeply slashes deposit rates; lowers lending rates marginally

Fri 08 Nov 2019, 15:56:44

Country's largest lender State Bank of India on Friday reduced its marginal cost of fund-based lending rate (MCLR) by 5 basis points across all tenors, effective November 10, and sharply slashed the deposits pricing between 15 and 75 basis points.

This is the seventh consecutive cut in lending rates by the bank this fiscal.

With this reduction, the one year MCLR, to which most of its loan prices are linked, will come down to 8 per

cent, the bank said in a statement.

cent, the bank said in a statement.

The bank also revised its interest rates on term deposits on account of adequate liquidity in the system. The new deposit rates will also be effective from November 10.

It has reduced interest rate on retail term deposit by 15 basis points for one year to less than two years' tenor.

Bulk term deposit interest rates have been reduced by 30 to 75 bps across tenors, the bank said.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

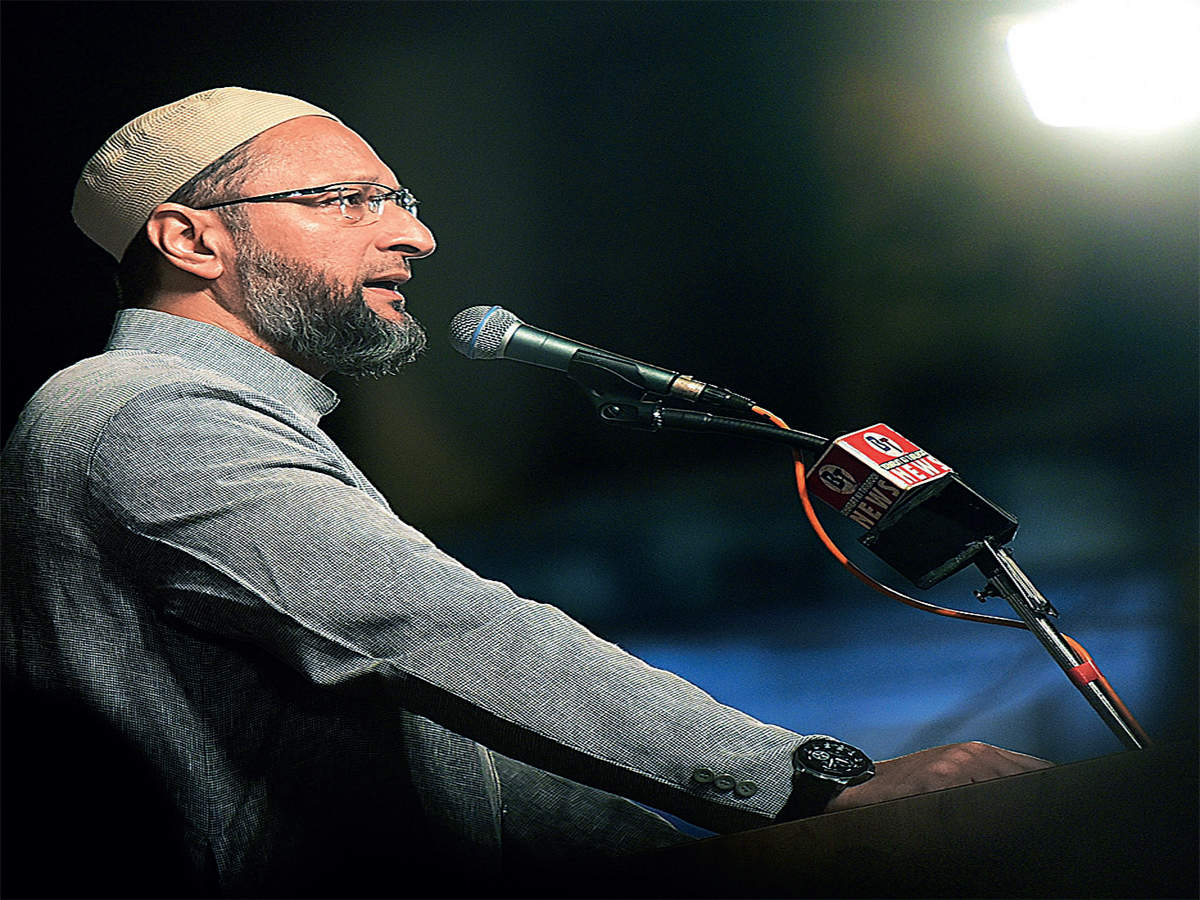

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which cricket team will win the IPL 2024?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2024 Etemaad Daily News, All Rights Reserved.