No GST on sale of old jewellery by individuals

Fri 14 Jul 2017, 10:43:48

Government has clarified that the sale of old jewellery by an individual to a jeweller will not attract any GST as the sale is not for furthering any business.In a statement, Finace Ministry said that the sale of old jewellery by an individual to a jeweller will not attract the provisions of GST and jeweller will not be liable to pay tax under reverse charge mechanism on such purchases.

The ministry,

however, said the tax will apply if an unregistered business sells gold ornaments to registered supplier.

however, said the tax will apply if an unregistered business sells gold ornaments to registered supplier.

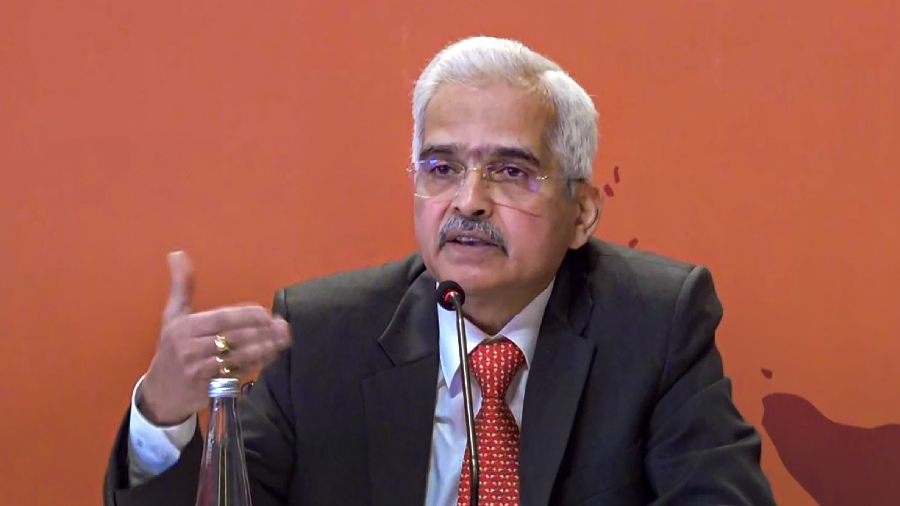

The clarification came in the wake of Revenue Secretary Hasmukh Adhia's comments in which he had said that the purchase of old gold jewellery by a jeweller from a consumer will be subject to GST at the rate of 3 percent under reverse charge mechanism of Goods and Service Tax.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which cricket team will win the IPL 2024?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2024 Etemaad Daily News, All Rights Reserved.