CBDT revised return forms for FY 2019-20 to be notified by end of this month

Mon 20 Apr 2020, 11:00:19

Central Board of Direct Taxes is revising the return forms for Financial Year 2019-20 which shall be notified by the end of this month. This is being done in order to enable income tax payers to avail full benefit of various timeline extensions upto 30th of June granted by Centre due to COVID-19 pandemic.

The CBDT has initiated necessary changes in the return forms so that taxpayers could take benefits of their transactions carried

out during the period from 1st April to 30th June this year in the return forms for Financial Year 2019-20.

out during the period from 1st April to 30th June this year in the return forms for Financial Year 2019-20.

Once the revised forms are notified, it will further necessitate the consequential changes in the software and return filing utility. Hence, the return filing utility after incorporating necessary changes shall be made available by 31st May to avail benefits for 2019-20.

No Comments For This Post, Be first to write a Comment.

Most viewed from Business

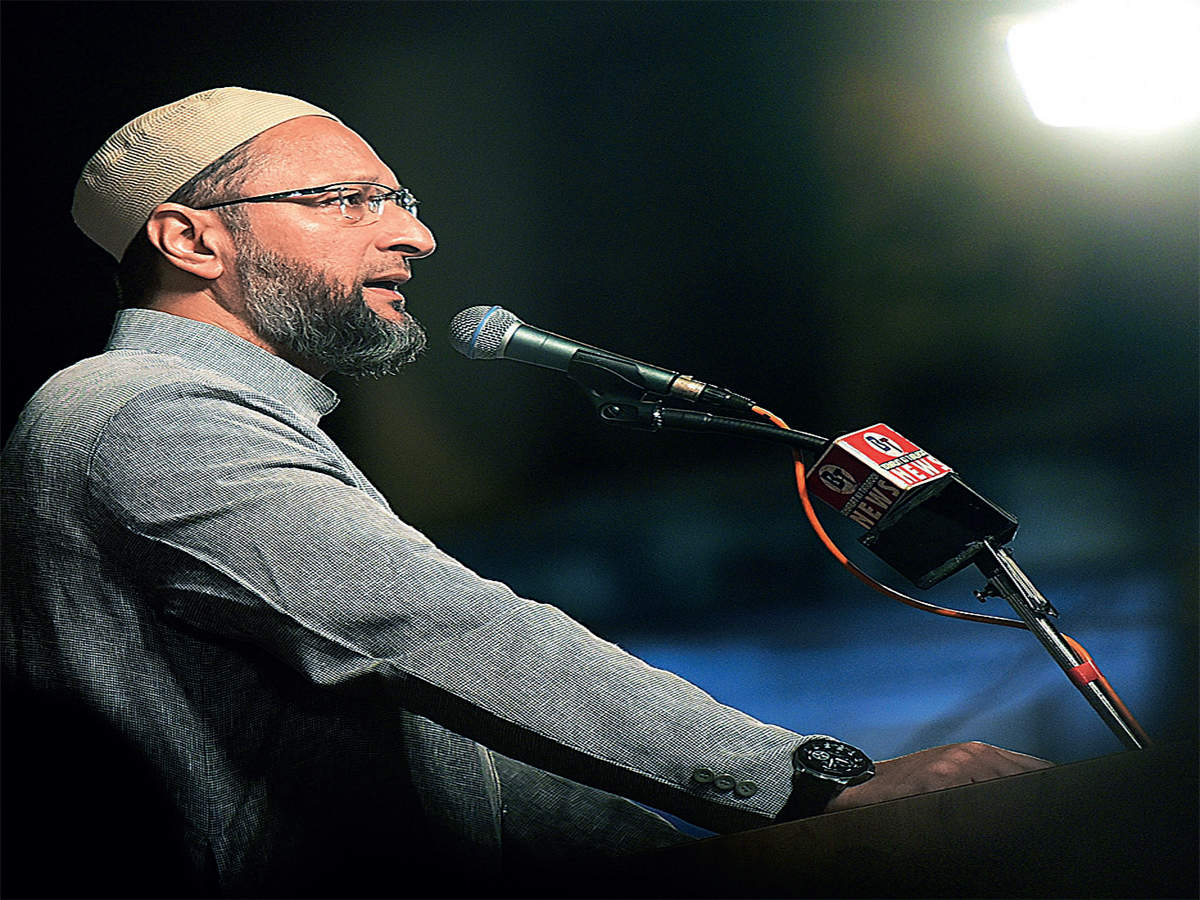

AIMIM News

Latest Urdu News

Most Viewed

May 26, 2020

Which cricket team will win the IPL 2024?

Latest Videos View All

Like Us

Home

About Us

Advertise With Us

All Polls

Epaper Archives

Privacy Policy

Contact Us

Download Etemaad App

© 2024 Etemaad Daily News, All Rights Reserved.